If you are struggling to navigate the brave new world of exports, tariffs and Rules of Origin, Martyn Moore extends a guiding hand

IT probably won’t have escaped the notice of most Made in Britain members that the UK has now left the EU. It started about four years ago and it happened on 31 December 2020. It somehow feels quicker...

So, from 1 January this year, exporting goods from the UK changed. It didn’t change as much as it might have, were it not for this piece of challenging bedtime reading here, known as the UK/EU Trade and Customs Agreement (TCA). Download a copy for yourself; it’s a little bit of history. Here’s the link again in full this time: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/948119/EU-UK_Trade_and_Cooperation_Agreement_24.12.2020.pdf

At the heart of this agreement are the conditions for continued zero-tariff trade between the UK and the EU. In the words of one civil servant, ‘it is complex’ and you might seek the services of a customs agent or a third-party customs intermediary to help with this but if that option isn’t available to you, well, you have some homework to do.

But Made in Britain is here to help and here’s the chief executive John Pearce with some comforting words of reassurance: “We know that 80 per cent of our members are exporting their goods to at least one or, in some cases, many different countries around the world, including to the EU trading block. The provenance of your products and the origin of the materials and components you’re using to make it will affect what tariffs apply and those tariffs will vary depending on what percentage of your components are sourced in the UK.

“The new trading regime is straightforward, but it is not the same as it was in 2020. Your business may need to seek professional advice to avoid the risk of any transit delays. This is vitally important if your product is perishable. Made in Britain is making a commitment to help our members wherever we can, by signposting to customs and excise professional bodies and providing a platform for our members to seek out advice from each other.”

That help starts here.

We thought a policy advisor at the government’s Department for Business, Energy and Industrial Strategy (BEIS) would be a good person to start us off by telling us what the Rules of Origin are.

“Rules of Origin determine the economic nationality of a good. So that’s where that product has been made, taking into account the processing, where its parts come from. They are a standard part of free trade agreements,” explains the BEIS spokesperson. “Goods produced in the UK and EU are eligible for zero tariffs, however, traders must prove that these goods are actually produced in the UK or EU to access this zero-tariff benefit. To do this, goods must meet Rules of Origin requirements as set out in the TCA and also have the documentation to prove this. If not, then the goods might be subject to tariffs, either when imported into the EU or when imported into the UK.”

Now you can see why we offered you a copy of the TCA.

Goods that are imported into Great Britain, which have cleared customs, can’t be freely circulated in EU member states and vice-versa; goods that have cleared EU customs can’t be freely circulated in the UK. So, to be eligible for zero tariff export to the EU, these goods must still comply with Rules of Origin. What this means is there must be some significant production in the UK. If goods enter the UK and are then distributed into the EU with no manufacturing, no production, they might still face tariffs. This applies to EU goods going the other way as well.

For an exporter, there are three main things that you need to do to comply with the Rules of Origin. Firstly, classify your goods for the purposes of customs; then understand whether your goods meet the applicable rule of origin; and finally, know how to actually demonstrate that.

Classifying your goods is the first step you need to take to comply with Rules of Origin. For the purposes of international trade, all goods are classified under the Harmonised System, an internationally standardised system used to identify goods. This covers every single good you can imagine from human blood to an aeroplane.

The Harmonised System forms the first six digits of the ten-digit classification (commodity) code when importing goods into the UK or the EU. Goods are categorised into chapters (two digits), headings (four digits), and subheadings (six digits).

There is a tool on the gov.uk website to help you to classify your goods but here’s a quick example. Household dishwashers are classified under: chapter 84 – nuclear reactors, boilers, machinery and mechanical appliances; heading 8422 – dishwashing machines; machinery for cleaning or drying bottles or other containers… sub-heading 842211 – household dishwashing machines.

The look-up tool to help with goods classification is here: https://www.gov.uk/guidance/finding-commodity-codes-for-imports-or-exports

The second step is to understand whether your good meets the applicable Rule of Origin. You and your suppliers need to know where your materials or inputs come from – both those from within the UK and those imported from abroad. If all of your inputs originate in the UK, your product is eligible for zero tariffs. If you use inputs that do not originate in the UK, you must comply with Rules of Origin.

There are rules for different products (known as Product Specific Rules). You will need to work out whether your products comply, using the classification from the first step. You should refer to the list of Product Specific Rules in the TCA to find the applicable rule for your product. However, there are four types of rule that a product may need to meet:

1. Wholly Obtained (WO). If a product is fully grown, born or extracted from the UK it is eligible for preferential treatment. This mainly applies to agricultural products, for example, vegetables grown in the UK, but could also apply to, for example, mineral products extracted from the soil of the UK.

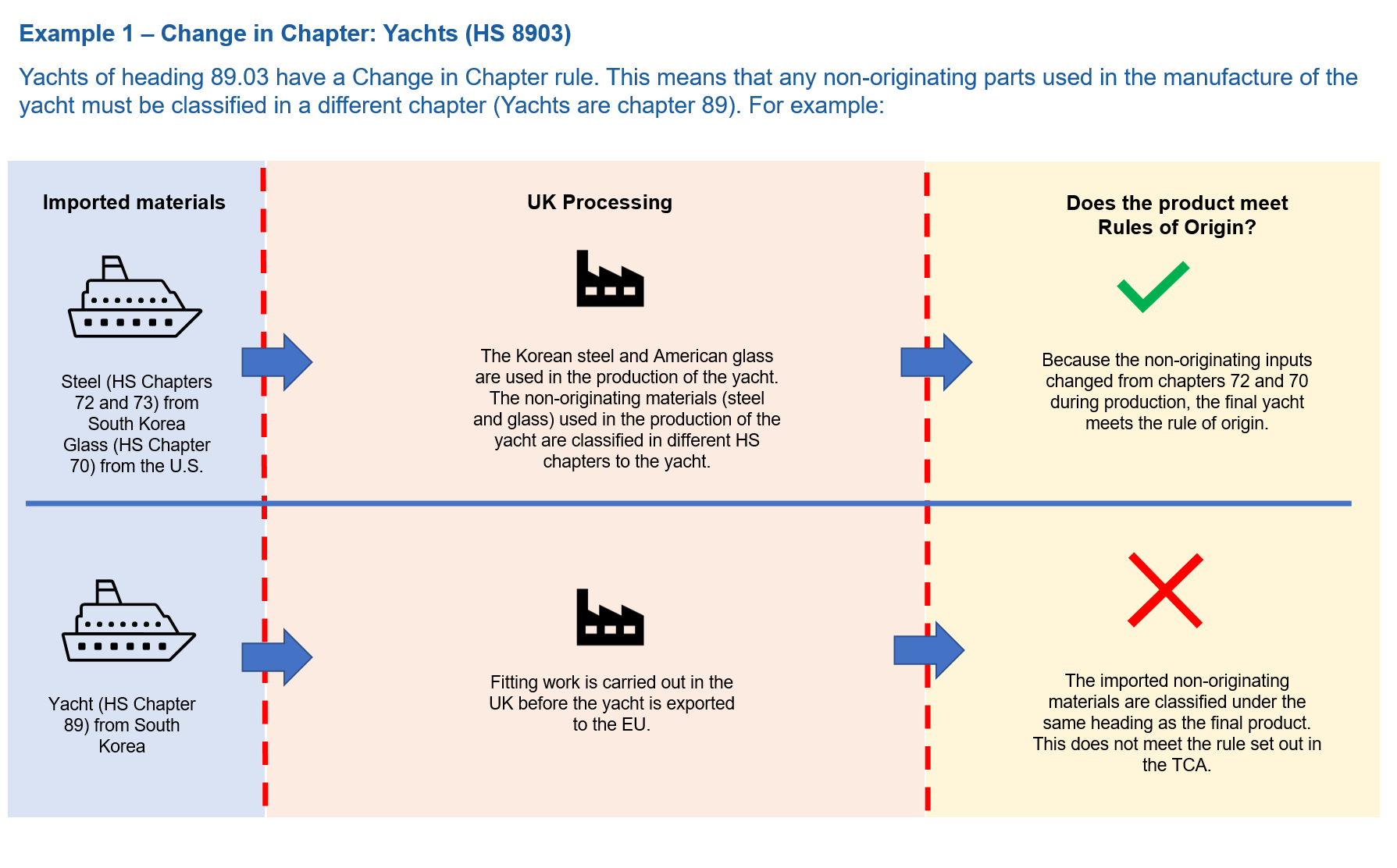

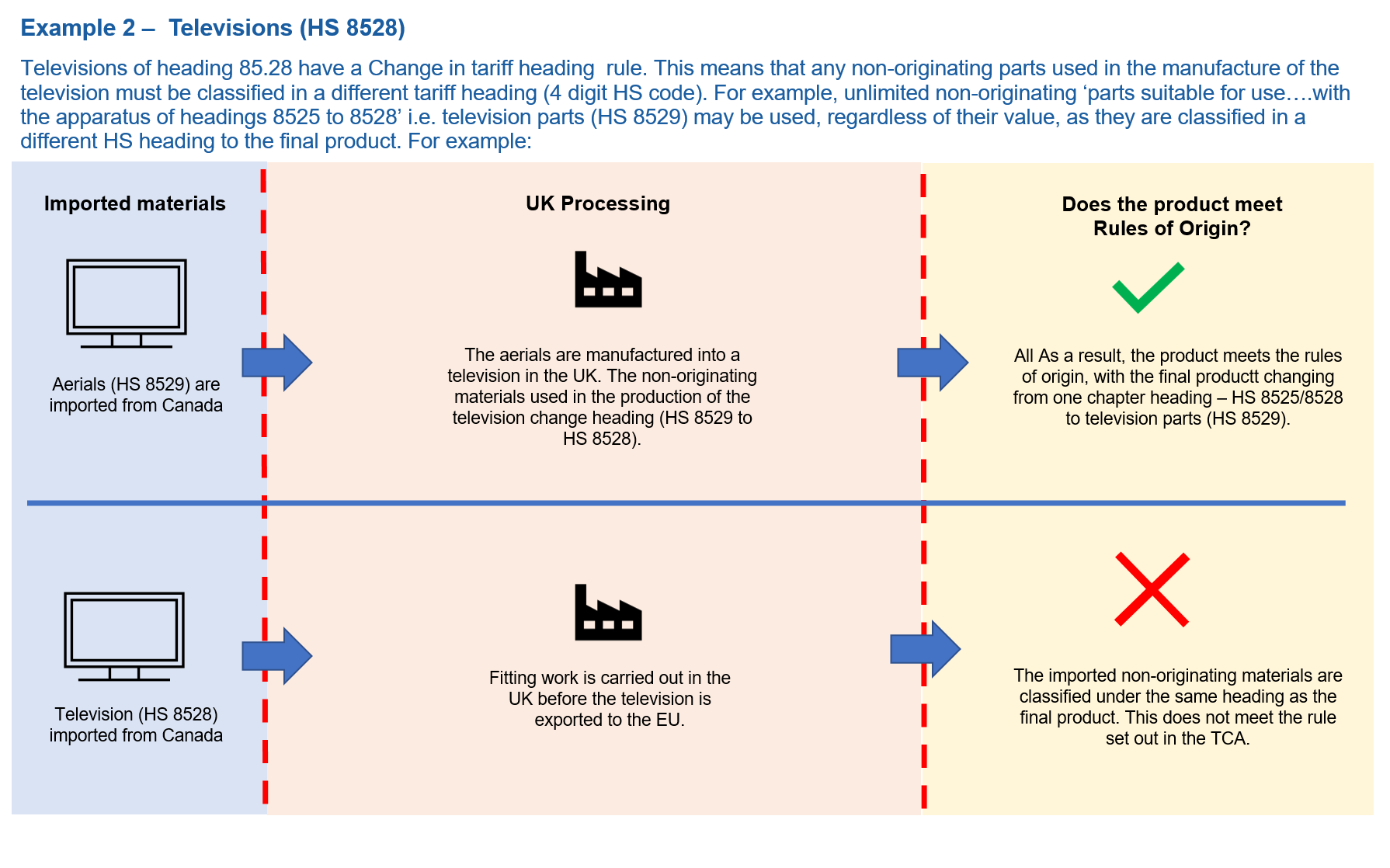

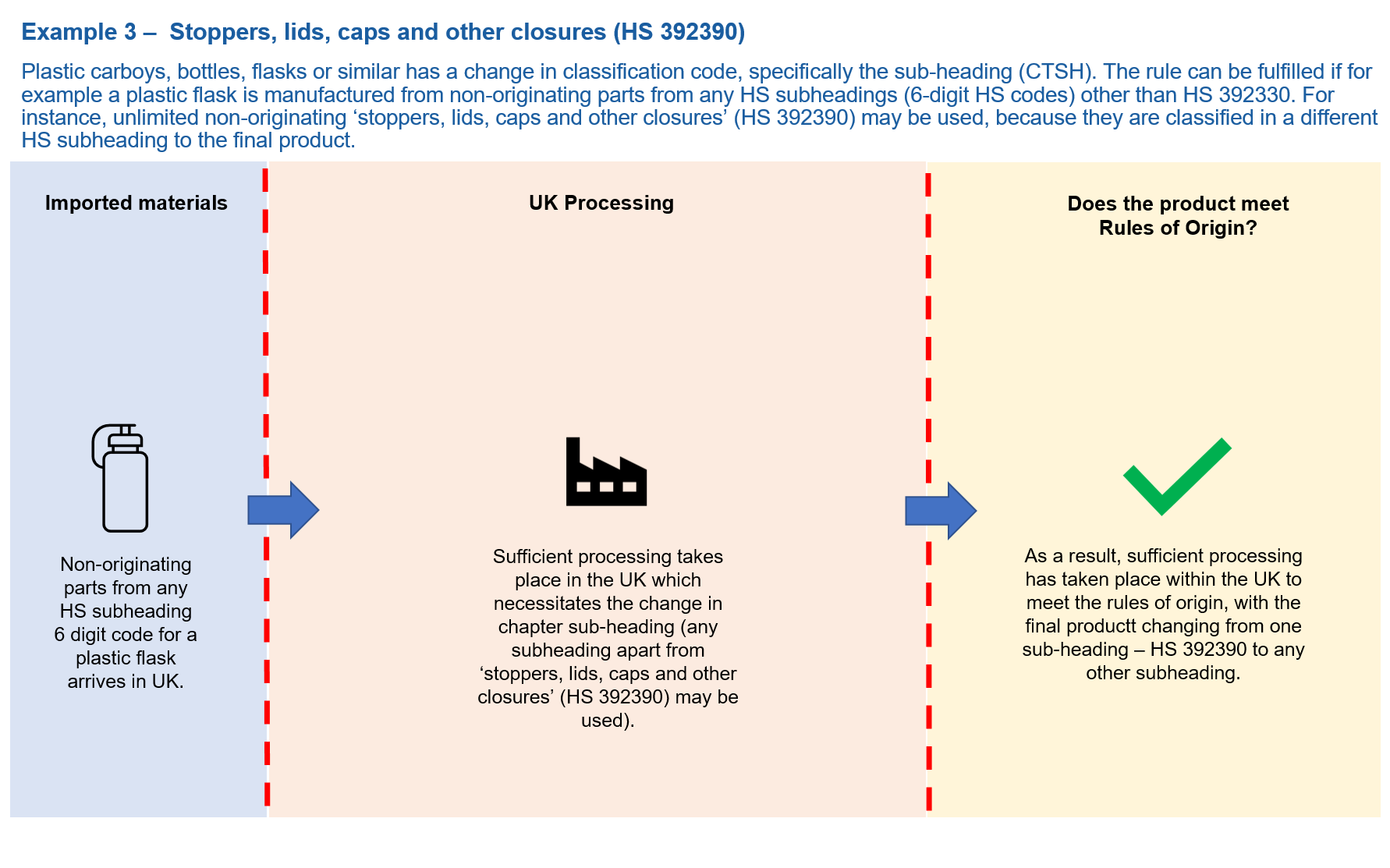

2. Change in Tariff Code (CTC). Some Rules of Origin require that non-originating (non-UK or EU) inputs used in a product must be classified in a different chapter, heading or subheading of the Harmonised System.

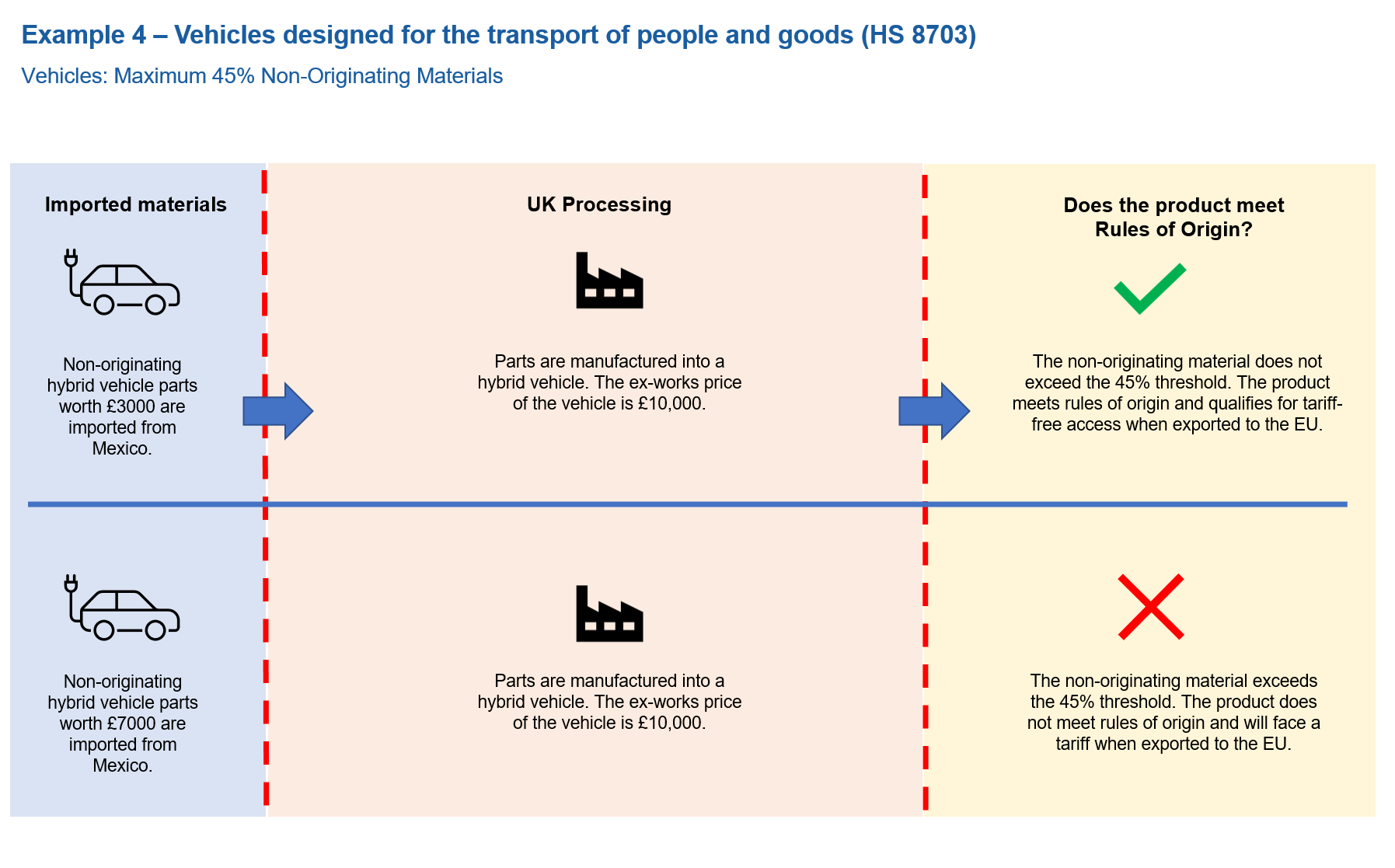

3. Value Added, or maximum non-originating material. If a rule requires a “maximum level of non-originating material” (MaxNOM), a certain amount of value of the final product must be generated in the UK, or the EU. This can include UK-originating parts, or value added in the production such as labour and manufacturing costs.

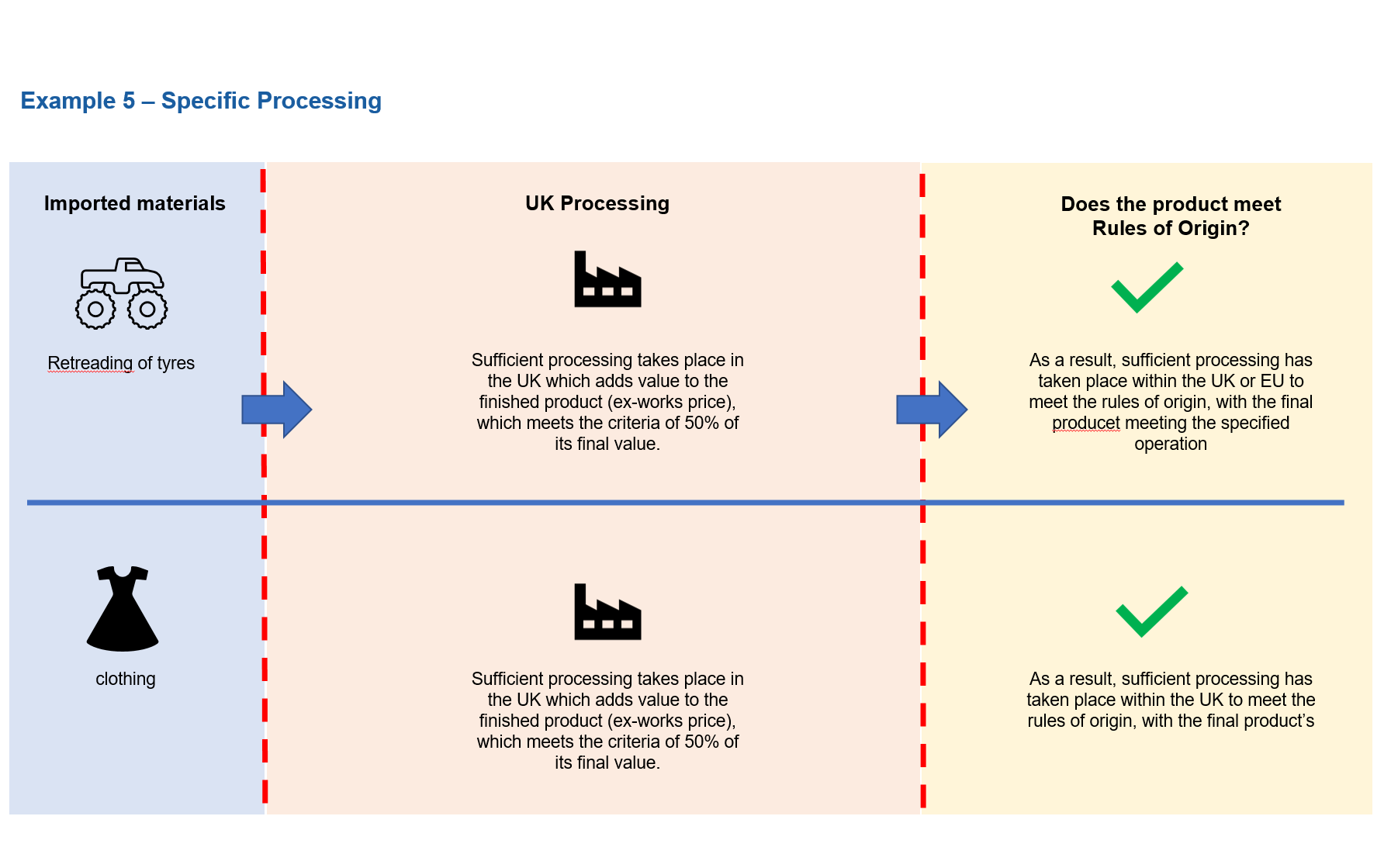

4. Specific Processing Rule (SPR). Some rules require a specific operation or set of operations to take place in the UK, in order for that product to be classed as UK-originating. For example, for certain chemicals, a chemical reaction must take place in the UK.

It’s all very well putting this down in black and white but sometimes it takes a nice picture to help it all sink in. BEIS has helpfully provided five:

And finally, step three, you need to understand how to demonstrate origin to customs authorities. That is, you must have evidence to prove your goods meet their product-specific rule of origin.

You may also require separate declarations from your suppliers, for example, a bill of materials or supplier declarations. You can self-declare that your goods meet the rules by making out a statement on origin and sending this to your customer. Your customer can use this as the basis of their preference claim.

Importers can alternatively claim preference based on importer’s knowledge. Where this option is used, you do not need to provide your customer with a statement on origin, though they may ask you to provide information about the goods to support their preference claim.

Until 31 December 2021, UK and EU exporters do not need supplier’s declarations in place when the goods are exported, but they must be confident that the exported goods meet the Rules of Origin requirements. Businesses may be asked to retrospectively provide a supplier’s declaration after this date.

To access zero tariffs when importing into the UK, you will need to claim preference as part of your customs declaration. You will need to hold proof that the goods you are importing meet the Rules of Origin. A statement on origin should be provided to you by the exporter on a commercial document. Under the TCA, preference is claimed either via a statement of origin or importer’s knowledge that the goods are originating and you can choose which option to use.

To use importer’s knowledge, you will need to obtain sufficient evidence that the goods meet the Rules of Origin. This may involve the exporter providing a range of supporting documentation.

There is an easement in place for UK companies importing products from the EU - they can defer tariff payments for up to six months from 1 January 2021 (except for certain controlled goods). This easement is only for UK companies importing from the EU and is not reciprocated in the other direction.

So, there you have it, the Made in Britain beginner’s guide to Rules of Origin. Now, we know that this is very basic and doesn’t deal with specifics. You know that you have work to do to get to grips with all of this and you will be dealing with very specific materials, processes and products.

To try to help you through the maze, we have put together a team of experts who will try to answer your questions around Rules of Origin. If you have any questions, please email them to editor@madeinbritain.org and we will field those questions to the expert team member best-placed to answer it. We should say that we are only able to give advice and guidance and that may include referring a question to a higher authority. We don’t guarantee we will be able to answer all your questions but we’ll have a jolly good try. We also can’t accept responsibility for any actions you take as a result of advice given on this website. Just wanted to make that clear.

This text is littered with useful hyperlinks to help you find the source material on the government websites. We thought it might help you if we also collected them together into one single page that you can bookmark in your browser, so to see all the links as a list, click here.

By Made in Britain 4 years ago | By Made in Britain