HOW many people know that energy itself accounts for less than 30 per cent of their electricity bills? More than 70 per cent goes to network, operating, environmental, social obligation and other costs, according to Ofgem.

Fundamentals Ltd think it’s time for the industry to be totally transparent about where the money is going. Who is doing what and who is paying for what – starting with a clear breakdown of costs on every electricity bill.

Electricity retailers may be reluctant to reveal their costs and profit margins (yellow ‘operating cost’) but it would be interesting for customers to learn that network costs account for less than a quarter of their bills. We think that is excellent value for all the wires, cables, substations, other assets and personnel that deliver their power.

At Fundamentals we propose a grown-up conversation with our customers, fellow members of the industry, politicians and pundits, about what needs to be done and the price we will all have to pay for achieving a net carbon zero future. Probably less than many experts believed a few years ago, in fact.

Along the way, some popular myths need busting and robust evidence presented for where and why money is being spent.

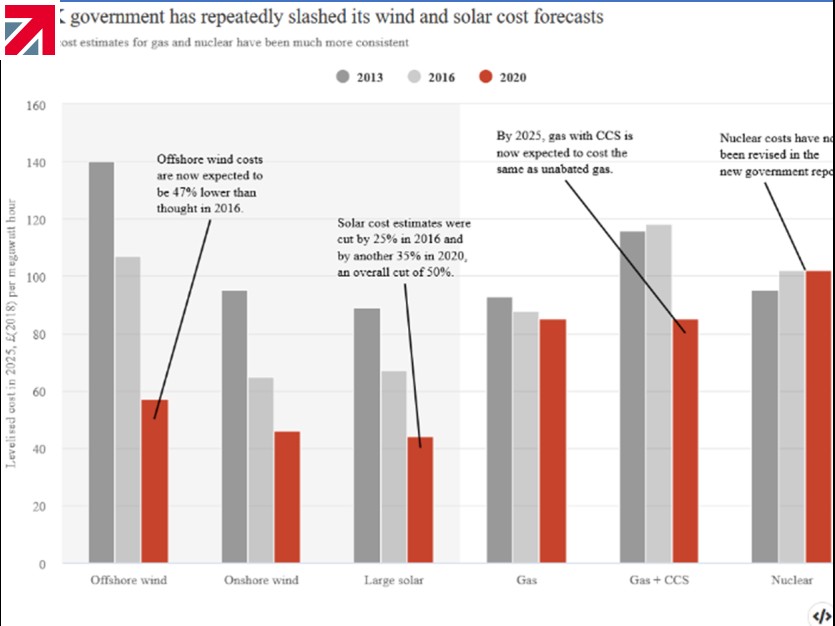

The notion that Wind And Solar Power (WASP) solutions are unaffordable alternatives to gas has been blown out of the water by the Department for Business, Energy and Industrial Strategy’s BEIS Electricity Generation Costs (2020) report. Analysis of the report by Carbon Brief shows large WASP installations are already able to operate subsidy-free and will generate electricity at a fraction of the cost of gas by 2025.

BEIS’s projections are based on ‘levelised costs’ – the whole life costs of building, operating and decommissioning plant. It also looks at ‘enhanced levelised costs’ i.e. whole system costs – including financial implications across the electricity industry in total. And this is where things get interesting for DNOs/DSOs.

WHOLE SYSTEM COSTS AND BENEFITS

Increasing WASP generation could actually lower the wholesale price of electricity in the medium term.

It is certain that ramping up WASPs will present enormous challenges - and major opportunities - for the distribution sector. Adapting distribution grids for a net-zero carbon future will incur costs of investment and innovation. But it must also factor in potential benefits for customers and the environment.

The UK Energy Research Centre (UKERC) Ofgem RIIO-ED2 consultation response argues convincingly that the industry needs a range of responses to handle more and more Variable Renewable Energy (VRE) sources. There is no single solution. Rather, it needs a combination of technologies to increase network flexibility, together with network reinforcement, based on industry-wide modelling of different scenarios. These scenarios will inevitably change with time and experience – but too much focus on flexibility, or on reinforcement, are likely to be high-cost options in the long run. It needs both.

UKERC says the need for network flexibility will increase as VRE penetration increases and there are more instances where demand exceeds baseload supply from intermittent sources. The gaps can be met partly with international interconnects, more storage, more reserve generating capacity, time-of-use pricing and demand-side management. We would include active voltage management.

But UKERC adds: “Flexibility can only go so far in helping meet power supply needs; at some point, network capacity often proves the most cost-effective means, especially when considering its reliability and lifetime, and the opportunities provided by asset replacement.

“The triggering of investment in network assets presents an opportunity not just to meet the immediate need or that are forecast for the next few years, but to provide for the maximum transfer that can be envisaged throughout the path to net-zero. This is likely to be cheapest for consumers over the longer term as the incremental cost of additional electrical capacity is small relative to the total cost of a project, it avoids the need for repeated interventions, and it saves on the long-term cost of network losses.”

UKERC’s submission concludes: “The greatest challenges faced by DNOs in forming investment plans relate to the gathering and use of information with suitable levels of spatial and temporal detail. Access to ‘smart meter’ data should help, but innovation will be required to turn data into useful information.”

Innovation examples include Northern Powergrid’s BEET (Boston Spa Energy Efficiency Trial) project, which trials the use of real-time data from consumer smart meters to adjust our SuperTAPP AVC (Automatic Voltage Control) units. This optimises network voltages and customer load efficiency. Northern Powergrid projects that a nationwide rollout of the solution could save up to £500,000 and two million tonnes of carbon dioxide.

THE BOTTOM LINE

So – increasing WASP generation may, in itself, lower the cost of electricity production. But that leaves the question of capacity to respond to the unexpected loss of large traditional generation sources – and the future of nuclear, which remains uncertain.

The future of the electricity industry is difficult to map with complete certainty. But alongside the challenges are many exciting opportunities for innovation and intelligent investment.

Fundamentals believes Ofgem and the industry need to take a whole-system view of what needs to be done and how much it will cost. Next up are some big decisions on how to fund the transformation – whether through customer bills, general taxation or government borrowing. Another balancing act.

We then need to communicate directly to customers, spelling out where the money is coming from, where it is going and what they (and the environment) are getting for it. It is the only way to take our ultimate stakeholders along with us on the journey to net-zero carbon.

Picture Credit: Ofgem

Picture Credit: Carbon Brief

Find out more about Fundamentals Ltd on their member profile page here

Member-created content 3 years ago | From members